2020 Drilling, Completions, and Frac Sand Demand and Projections

How will E&Ps and service providers operate in the new capital discipline environment of 2020? Shale experts Ryan Hassler and Thomas Jacob with Rystad Energy discussed the outlook for 2020 and what to expect in terms of capex, drilling and completions projections, frac sand demand and pricing.

To begin, it’s important to recognize that oil and gas price forecast drive the estimations in oilfield activity; which in turn drive service demand estimates. 2020 drilling and completions capex is estimated to be down 10% year over year. However, activity probably won’t be down at the same level due to service price deflation and drilling and completion efficiency gains.

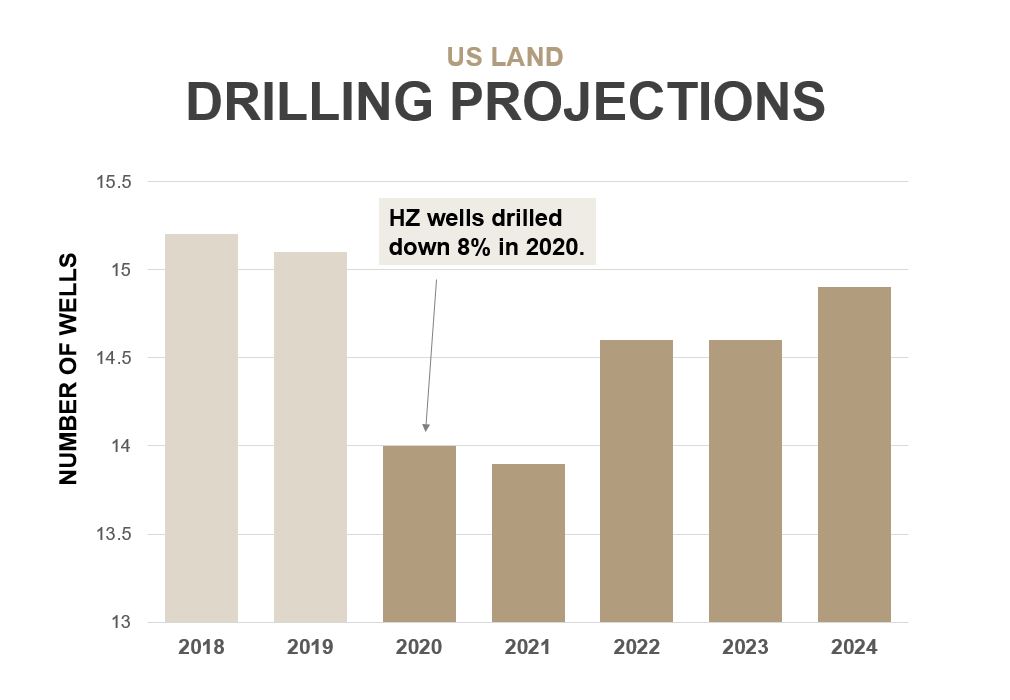

DRILLING

Even though rig counts have declined substantially, it hasn’t translated into an equivalent decline in wells drilled. Essentially, we’re drilling more wells on a per rig basis. Wells drilled per rig is a good measure of rig efficiencies.

Since capex for drilling and completions is expected to be down 10%, the implication in that is that we’ll see an 8% reduction in drilling activity in 2020. Rig count is expected to hover around the 800 mark for the next two years.

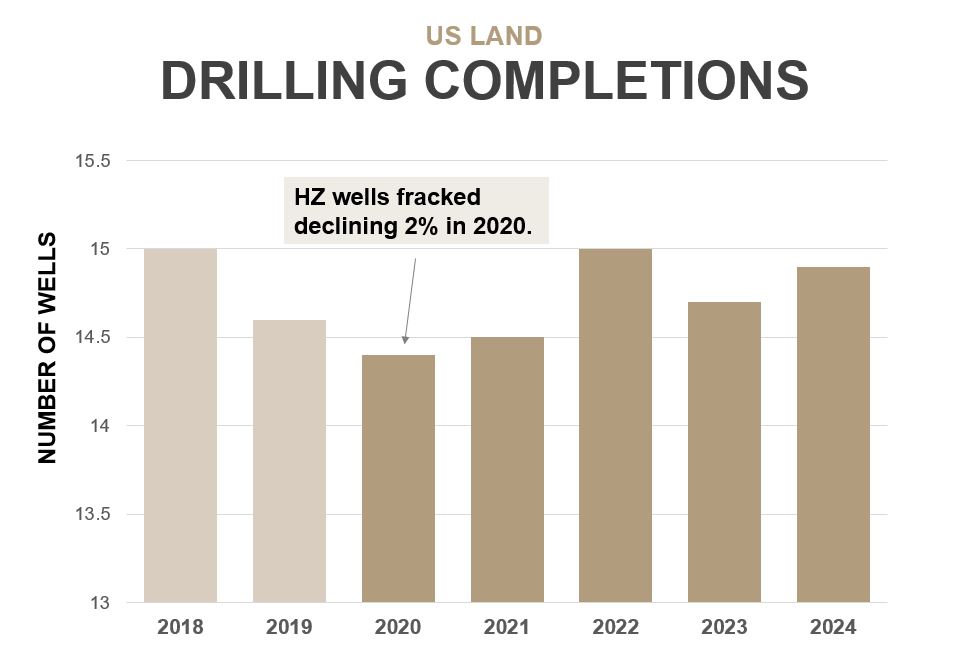

COMPLETIONS

Due to budget exhaustion at the end of 2019, completions were pushed out to 2020. The first half of 2020 is due to increase 10% because of this reason. For 2020 overall, wells fraced is estimated to decline 2% relative to 2029. There has been an increase in number of rigs being chased by one frac crew. The ratio of rigs to frac crews is a good measure of overall drilling and completions efficiency.

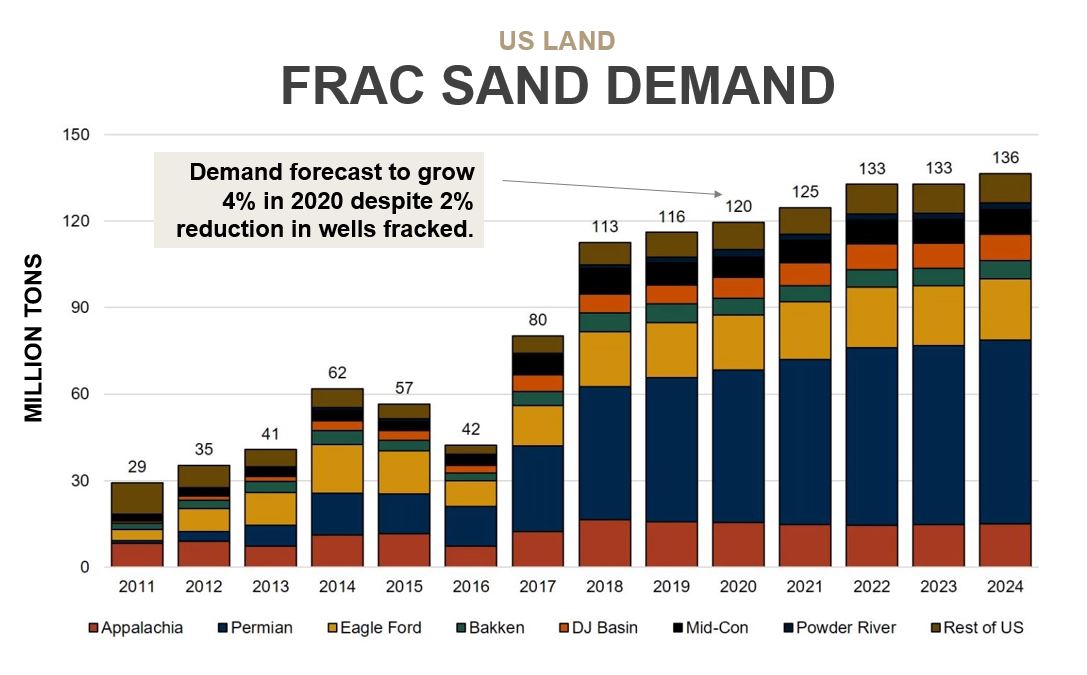

FRAC SAND DEMAND

Frac sand growth and demand is only expected to increase 3%, reaching 120MMtpa. Demand isn’t expected to surpass 140MMtpa over the next 5 years.

There are three main drivers for frac sand demand:

- Number of wells fraced

- Sand intensity – the amount of sand pumped at a per lateral foot basis

- Lateral length of the wells

With the price of oil ranging between $50-$60 per barrel, there is a ceiling on increases in wells fraced. On sand intensity, most major plays in the US have stabilized at 2000-2500 lbs per lateral foot. However, because of efficiencies at the wells, lateral lengths are increasing; especially in the Permian. This is where the estimated growth and demand for frac sand is coming from. The oversupply issue has caused frac sand prices to drop significantly in 2019; however, it is expected to be resolved in 2020.

CONCLUSION

To recap, capex is expected to go down 10 percent and drilling and completions will only see losses at 8 and 2 percent. Primarily, this is driven by efficiency gains. Overall, there is still room to grow across the U.S. We will continue to see gains over the next few years as operators and service providers catch the leading edge – giving operators the ability to complete more work in less time with the same amount of equipment. We have entered into a new era of operations in the shale industry with operators putting a lot more effort into cost savings, supply chain optimization, and efficiency gains.