2019 Oil and Gas Outlook According to Experts

2018 Oil & Gas Price Recap

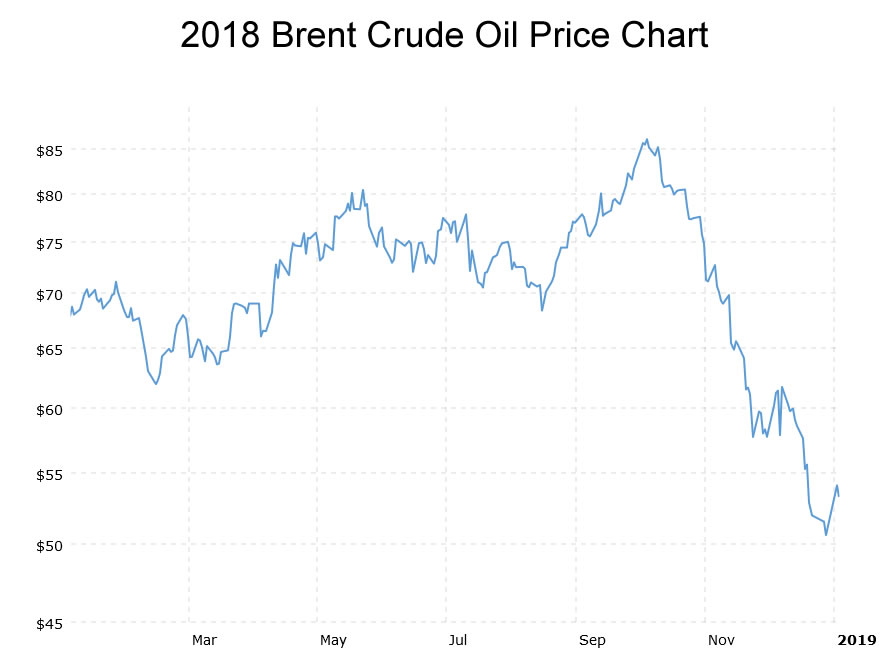

2018 was a volatile year for the oil and gas industry, featuring both good news and bad news. Brent crude prices started the year around $66 per barrel, climbed to $86 per barrel, and dropped down to yearly lows in December around $54 per barrel.

Image Source MacroTrends.net

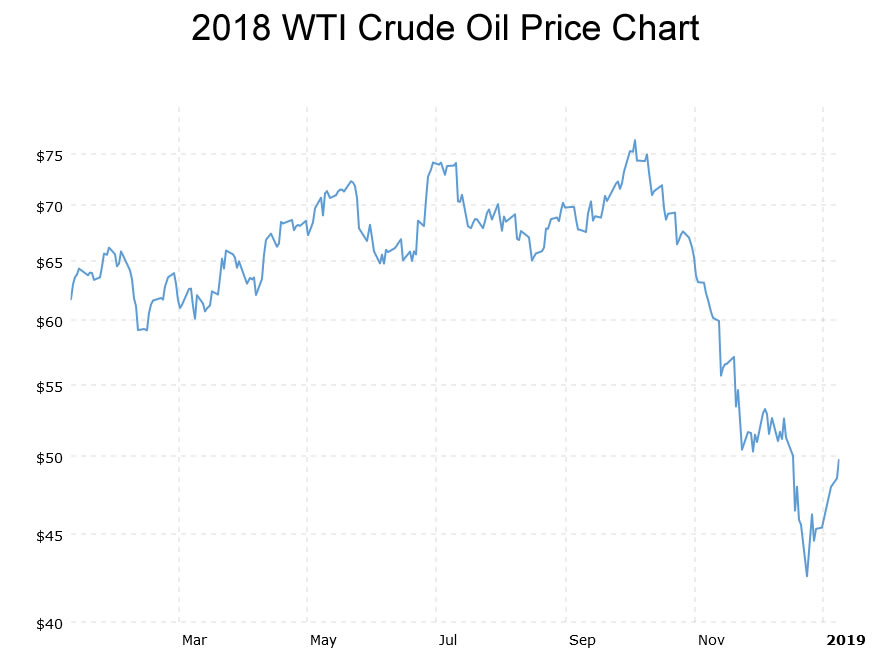

WTI followed a similar pattern starting the year around $60 per barrel, climbed to around $80 per barrel, and then dropped all the way down to around $45 per barrel.

Image Source MacroTrends.net

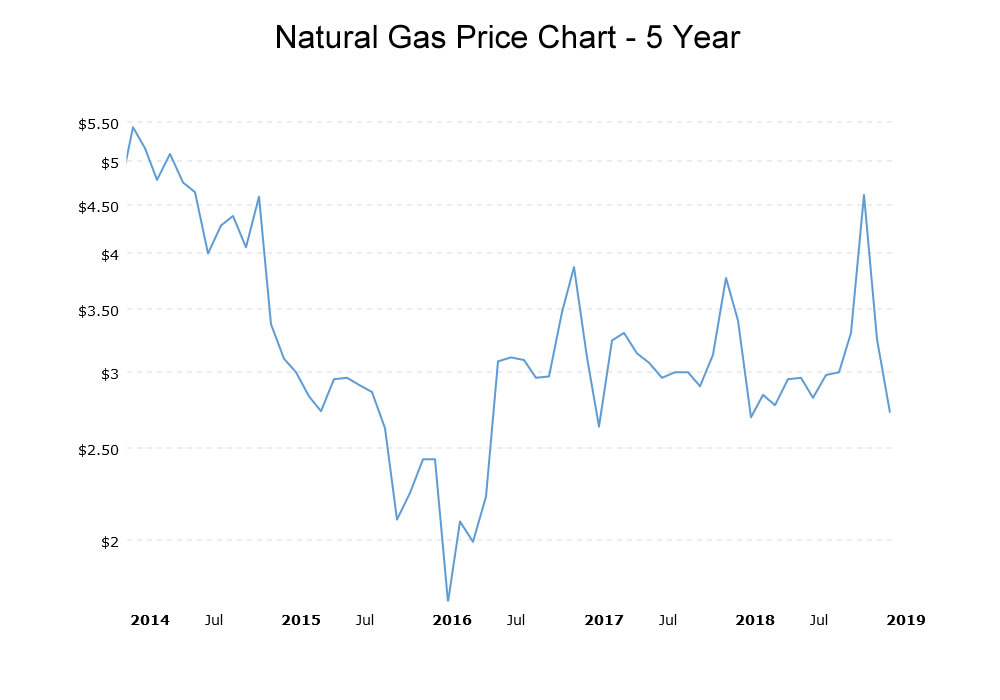

Natural gas started off in 2018 averaging $3.87 per MMBtu (Dollars per Million Btu) in January of 2018. In February, prices dropped off to around $2.67 per MMBtu and did not rise above an average of $3.00 per MMBtu until October, where prices averaged $3.28 per MMBtu.

November and December were strong months for natural gas as prices surged above $4.00 per MMBtu for the first time in four years, reaching almost $5.00 per MMBtu. Prices then fell and ended the year at around $3.25 per MMBtu.

Image Source MacroTrends.net

2018 Oil & Gas Industry Highlights

The U.S. oil and gas industry reached major milestones in 2018 while also announcing the discovery of the largest oil/natural gas reserve in history. Here are some of the key highlights for 2018.

- The United States unseated Russia and Saudi Arabia and became the world’s largest oil producer.

- The U.S. became a net oil exporter for the first time in decades.

- U.S. natural gas production increased to approximately 76.9 bcfd from 62.8 bcfd a year prior.

- Feds discovered Largest Oil, Natural-Gas Reserve in history.

- Natural Gas prices topped $4.00 per MMBtu for the first time since 2014.

- Permian pipeline takeaway capacity held crude production at bay.

- President Trump “Energy Cabinet” makeover with Tillerson, Pruitt, and Zinke replaced.

2019 Oil & Gas Industry Outlook According to the Experts

Making predictions for the oil and gas industry goes way beyond simply calculating supply and demand. Regional and global economics come into play as well as geopolitical factors. Even the weather is a variable when forecasting oil and gas prices. So, we’ll leave the forecasting to the experts and see what they have to say about the oil and gas industry outlook for 2019.

Oil and Gas Investor 2019 Outlook

Oil and Gas Investor recently released an article in which the author, Ashley Petersen, addresses three questions for 2019. Will the global economy continue to slow? Will there be too much crude oil? And will there be enough diesel? The answers to these questions should play a key role in crude oil prices throughout the year according to Petersen. Petersen is the Lead Oil Market Analyst at Stratas Advisors. Petersen expects that Brent crude will average around $72 per barrel in 2019 and WTI to average around $64/bbl for the year based on her assumptions.

Goldman Sachs Group Inc. Outlook

Goldman Sachs Group Inc. slashed its oil price forecast for 2019 by almost 10% from their previous estimates based on crude surplus and increasing U.S. shale production. Goldman analyst Damien Courvalin stated that Brent crude would average just $62.50 per barrel in 2019, down from the prior forecasted $70 per barrel.

Goldman further pointed out that OPEC production surged in late 2018 which helped lead to the surplus. Bottlenecks in Permian Basin takeaway capacity are also slated to be relieved sooner than expected as new pipeline projects come online in the first quarter of 2019.

JP Morgan Outlook

JP Morgan is another who also cut its oil price outlook for 2019. Originally, the bank’s forecast had Brent crude oil averaging $83.50 per barrel in 2019. They have since revised their forecast down to a $73 per barrel average for Brent crude in 2019. Scott Darling, head of Asia-Pacific Oil and Gas at JP Morgan told CNBC that slowing demand growth will weigh down crude prices in 2019.

Seeking Alpha Outlook

In Seeking Alpha’s post, 2019 Oil Market Outlook: OPEC Will Cause Prices to End Up Higher Than Forecast, the author points to the 1.2 million barrel per day production cut agreed upon by OPEC and Russia in December of 2018 as one of the reasons he estimates that crude prices will be higher than many are predicting for 2019. He believes the production cut agreement will not only be extended, but possibly expanded as well, leading to a quicker than expected price recovery. Seeking Alpha’s prediction for 2019 has Brent crude averaging in the low $60s per barrel for the first half of the year and increasing to $70 per barrel in the second half of 2019.

EIA 2019 Outlook

In the EIA’s Short-Term Energy Outlook released on December 11, 2018, the EIA predicts Brent crude to average $61 per barrel in 2019 and WTI to average $54 per barrel for the year. This was a downward revision of $11 per barrel from the November Short-Term Energy Outlook forecast of $72 for Brent and $65 for WTI. The EIA sited increasing evidence of oversupply in 2019 as the reason for the adjusted forecast.

In December’s report, the EIA stated it expects downward pressure on natural gas prices from strong growth in U.S. production. The EIA predicts Henry Hub natural gas spot prices to average $3.11/MMBtu in 2019. This is down 6 cents from the 2018 average for natural gas and down 77 cents from a forecasted average price of $3.88/MMBtu in the fourth quarter of 2018. The EIA expects dry natural gas production in April of 2019 will be 90 Bcf/d, which is 2 Bcf/d higher than current production levels. This level of production is anticipated to push prices lower after winter demand wanes.

Javier Blas on Bloomberg

Texas Is About to Create OPEC’s Worst Nightmare was the title that rocked the global oil and gas industry in November of 2018. Mike Loya, the top executive in the Americas for Vitol Group, the world’s largest independent oil-trading house, is quoted in the piece as saying, “The Permian will continue to grow and OPEC needs to learn to live with it.”

The article paints OPEC as being between the proverbial rock and a hard place. If OPEC cuts production, as they agreed to do in December, then OPEC along with Russia and others could lose market share to Permian producers. If they don’t cut production, they would likely face continued falling oil prices, which they can ill-afford.

Many Permian producers have evolved and can still turn a profit if crude prices fall to as low as $30 per barrel. Most OPEC countries and other oil producing countries where oil is a critical component of their economy cannot “pay the bills” with oil prices that low. For example, in Saudi Arabia, the petroleum sector accounts for approximately 87% of their budget revenue and 90% of their export earnings. The Saudi budget’s breakeven price for crude is in the mid-$80s per barrel. In Russia, the energy sector accounts for around 52% of their budget revenues and over 70% of their total exports.

To make matters even worse for OPEC is that Permian pipeline projects are coming online in 2019 that could potentially add two million barrels per day of takeaway capacity to the region. This would alleviate the bottlenecks in transporting West Texas Intermediate crude to refineries along the gulf coast as well as to shipping points in Houston and Corpus Christi. It could also potentially help close the gap in price between Brent crude and WTI.

Geopolitical Risks

One area the experts didn’t dwell on significantly in their predictions for the oil and gas industry was geopolitical risks. The possibility of a trade war between the U.S. and China could affect oil and gas as well as the global economy –– and not in a good way. Further tensions in the Middle East could erupt and easily affect global oil prices, sending them shooting back up in the event of crude supplies being threatened or disrupted.

Other geopolitical risks that could influence oil and gas include the conflict with Russia and Ukraine, Saudi Arabia and UAE aspirations, and the possible collapse of Venezuela to name a few. It is safe to assume that oil company executives have plans in place to activate at a moment’s notice should geopolitical factors dictate the necessity.

2019 Oil & Gas Industry Outlook Highlights

- Permian pipeline projects coming online in 2019 could unleash crude production to new record levels.

- EIA forecasts the Henry Hub spot price of natural gas to average $3.11/MMBtu in 2019.

- Record DUC wells factor into record frac sand demand for 2019.

- Stratas Advisors expects $72 per barrel Brent crude oil in 2019.

- Goldman Sachs forecasts $62.50 per barrel Brent crude oil in 2019.

- The EIA predicts $61 per barrel average for Brent crude in 2019 and WTI to average $7 per barrel less than Brent.

- Seeking Alpha predicting crude prices in the low $70s per barrel by mid-2019.

- World Bank Cuts Oil Price Forecast to $67 per barrel.

Conclusion

Many experts such as Goldman Sachs and the EIA are anticipating a flat year for oil and gas, while others such as Seeking Alpha are a little more optimistic. Brent crude oil price predictions for 2019 range from the low $60s per barrel to the mid-$70s per barrel, while the Saudis are hoping for even higher prices and are attempting to drive them back up to $80+ per barrel.

Bank of America Merrill Lynch economists predict global economic growth to slow down across almost all major economies in 2019. A global economic slowdown could also weaken demand in oil and gas.

On the flip side of this equation is that bottlenecks are set to be eliminated in the Permian Basin’s takeaway infrastructure, clearing the path for substantially increased production in the area, up to 2 million barrels per day. As of November 2018, there were over 4,000 Drilled Uncompleted (DUC) wells in inventory in the Permian Basin alone which could be completed in short order should the need arise. Good news for the frac sand industry in the basin.

How all of these factors play out in 2019 for oil and gas remains to be seen. Breaking news could change everything in the industry and prove all the experts wrong. In the meantime, we’ll just have to wait and see.